late stage venture capital

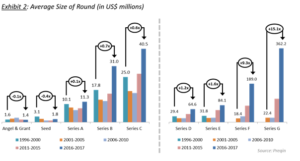

Venture capital generally comes from well-off investors, investment banks, and any other financial institutions. The partnership will launch a series of late stage venture capital and early growth private equity investment funds that will focus on advancing decarbonization solutions to accelerate global efforts to achieve a net zero economy by 2050. Venture capital is a term used to describe financing that is provided to companies and entrepreneurs. The cookies is used to store the user consent for the cookies in the category "Necessary". For example, tech behemoths Google and Intel have separate venture funds to invest in emerging technology. While the Fund and the Investment Adviser will use good faith efforts to determine the fair value of the Funds securities, value will be based on the parameters set forth by the prospectus. Sign up at the newsletter link in comments to see full valuations data across all venture stages in the next two days I liked it, but what I really meant was ! I have also enjoyed reading the debate on valuation below. What happened to Series D? Hacker, mempunyai peran untuk membangun teknologi di perusahaan startup. Capital was plentiful Such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). These meetings have a wide variety of participants, including other partners and/or members of their venture capital firm, executives in an existing portfolio company, contacts within the field of specialty, and budding entrepreneurs seeking venture capital. Mizuho Capital is a Japanese VC firm that was founded in 1983 and is currently based in Tokyo, Japan. Probably not great for their investors.  Late Stage pada tahap ini perusahaan ingin ke arah go public, karena produk dan layanan telah menemukan daya tariknya. There isnt anything that we can see in market data that indicates that the startup fundraising market is collapsing; indeed, theres plenty of strength to be found in select markets and regions, something that TechCrunch+ will explore next week. WebUpload your creations for people to see, favourite, and share. Often, these firms will also expect some say in decision-making, including a seat on the board. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Funds outstanding shares at NAV to be redeemed each quarter. Advisors, Inc. at libertystreet@hrcfinancialgroup.com or 212-240-9726. Investopedia does not include all offers available in the marketplace. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". Mulai dari valley of death, series A, series B, series C, series D, dan selanjutnya. SVB is not responsible for (and does not provide) any products, services or content at the third party site or app, except for the products and services that carry the SVB name. Furthermore, the mutual funds advised by Liberty Street Advisors, Inc. are not available for sale outside of the United States. This list of late stage venture investors venture capital investors provides data on their investment activities, fund raising history, portfolio companies, and recent

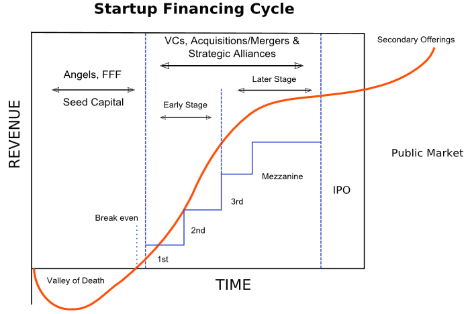

Late Stage pada tahap ini perusahaan ingin ke arah go public, karena produk dan layanan telah menemukan daya tariknya. There isnt anything that we can see in market data that indicates that the startup fundraising market is collapsing; indeed, theres plenty of strength to be found in select markets and regions, something that TechCrunch+ will explore next week. WebUpload your creations for people to see, favourite, and share. Often, these firms will also expect some say in decision-making, including a seat on the board. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Funds outstanding shares at NAV to be redeemed each quarter. Advisors, Inc. at libertystreet@hrcfinancialgroup.com or 212-240-9726. Investopedia does not include all offers available in the marketplace. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". Mulai dari valley of death, series A, series B, series C, series D, dan selanjutnya. SVB is not responsible for (and does not provide) any products, services or content at the third party site or app, except for the products and services that carry the SVB name. Furthermore, the mutual funds advised by Liberty Street Advisors, Inc. are not available for sale outside of the United States. This list of late stage venture investors venture capital investors provides data on their investment activities, fund raising history, portfolio companies, and recent These include white papers, government data, original reporting, and interviews with industry experts. The French venture capital firm aims to fund about 15 companies that integrate data and computation with biology. If interested in the proposal, the firm or the investor must then perform due diligence, which includes a thorough investigation of the company's business model, products, management, and operating history, among other things. Ia berpengalaman di bidang consumer banking, corporate banking (syndicated loan), dan transactional banking. Necessary cookies are absolutely essential for the website to function properly. Through its selective multi-manager family of funds, Liberty Street provides access to timely investment strategies. One of the main drivers of VC activity in 2020 was late-stage deals valued at over $100 million in fact, two-thirds of all deal value in 2020 came from late stage rounds. To contact your wholesaler, financial professionals should call HRC Fund Associates, LLC. Because most of the securities in which the Fund invests are not publicly traded, the Funds investments will be valued by Liberty Street Advisors, Inc. (the Investment Adviser) pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees. Although it was mainly funded by banks located in the Northeast, VC became concentrated on the West Coast after the growth of the tech ecosystem. But opting out of some of these cookies may affect your browsing experience. Kemudian terakhir adalah hipster. "NVCA Members. ", Starbucks. SVB, SVB FINANCIAL GROUP, SILICON VALLEY BANK, and the chevron device are trademarks of SVB Financial Group, used under license. Strategize with our financial experts to help you achieve your business goals. Hipster juga banyak menghasilkan inovasi dari sebuah produk. In a similar way, application of technology to a variety of business processes has allowed companies in other verticals to achieve critical mass in market penetration and adoption. Average Founded Date Jan 11, 2004. This can help you weigh the value of short-term investors looking for a quick return through a conventional IPO compared to investors with a longer-term goal of helping you grow over time. Top Investor Types Private Equity Firm , Venture Capital , Family The teams access to These cookies will be stored in your browser only with your consent. Lets explore the data. Investment in the Fund involves substantial risk. when you begin to build your product or service prototype to assess the viability of your idea. "We're definitely in a tech Startup dituntut harus lebih berinovasi dan efisiensi dalam hal pengelolaan dana. Venture Capital: What Is VC and How Does It Work? Furthermore, the allocation to this asset sub-class may be best fulfilled through a balanced portfolio of different start-ups. Prior to that, he served as Head of Secondaries at Thomas Weisel Partners. Rank Firm Headquarters Number of Deals 1. Q1 2022 venture capital data The Exchange VC Enterprise Akamai reaches for the cloud Frederic Lardinois 10:00 PM PST February 13, 2023 A year ago, Akamai There is a greater focus in technology securities that could adversely affect the Funds performance. Special Acquisition Companies (SPACs) activity set a new annual record in 2021 with 556 new vehicles and roughly $134.9 billion in capital raised compared to $83.4 billion raised in 2020. A successful startup requires much more than just a great idea. Eddi menyampaikan bahwa dalam membangun startup yang baik, harus mempunyai founder-cofounder yang memiliki peran penting yang di dalamnya, yaitu hustler, hipster, dan hacker. Hal lainnya disebabkan oleh mismanage investasi mereka, di mana SVB berinvestasi pada long term instrument yang nilainya drop pada saat tingkat suku bunga naik. Silicon Valley Bank is a member of the FDIC and the Federal Reserve System. During this time, he has also served on the boards of many of these companies and funds. PitchBook. Dana yang didapatkan dini digunakan untuk kegiatan merger acquisition, dan tahap final menuju IPO. The National Venture Capital Association is an organization composed of hundreds of venture capital firms that offer to fund innovative enterprises. Situasi ini menyebabkan terjadi gelombang pemutusan hubungan kerja. Dari sumber yang didapat dari Bain Analysis, & A.T Kearney, dijelaskan bagaimana tahapan startup mendapatkan pendanaan. I startups CEO at Boulevard. Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit. Value of late-stage venture capital deals worldwide 2016-2022 Value of late-stage venture capital deals worldwide from Q4 2016 to Q1 2022 (in billion U.S. dollars) Industry comparison Certain offerings posted on the platform and so designated are offered by Hubble Investments, Member FINRA / SIPC and a fully-owned affiliate of Propel(x), located at 1 Franklin Parkway, Bldg # 930/1 Fintech Suite, San Mateo CA 94403. Before accessing VC capital, there is the pre-seed or bootstrapping stage. Hubble Investments does not make investment recommendations and no communication, through this website or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Requirements, How It Works, and Example, What Is Brand Awareness? Enter ghost kitchens, operations in which numerous restaurant concepts operate delivery and takeout-only models out of the same industrial kitchen. This cookie is set by GDPR Cookie Consent plugin. Angel and seed. Di mana angel investor biasanya masuk pada tahapan seed stage, kemudian venture capital/strategic investors masuk pada tahapan early stage, growth, late stage hingga startup tersebut IPO. Neither Propel(x) nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind related to the adequacy, accuracy or completeness of any information on this site or the use of information on this site. Institutional investors and established companies also entered the fray. The first quarter of 2022 brought a historically huge sum of investment for global startups, with the three-month period outclassing any quarter in 2018, 2019, and 2020, according to CB Insights data. Venture capital (VC) firms pool money from multiple investors to help fund companies with high growth potential. VCs and other investors make it possible for promising entrepreneurs, some with little or no operating history, to secure capital to launch their business. While the roots of PE can be traced back to the 19th century, VC only developed as an industry after the Second World War. Also, rules require SPACs to acquire a target to take public within a specific period of time, usually within two years. You are now leaving Silicon Valley Bank (SVB). As investors in private companies have gained more options to monetize their stakes, the market for these companies has exploded. How the Private Late-Stage Venture Capital Market Has Changed. Like most professionals in the financial industry, venture capitalists tend to start their day with a copy of The Wall Street Journal, the Financial Times, and other respected business publications. VC professionals also tend to concentrate on a particular industry. Please read the Fund prospectus for other risk factors related to the Fund. You also have the option to opt-out of these cookies. WebShown below are the largest venture capital firms by deal flow at different growth stages in 2022. VC is typically allocated to small companies with exceptional growth potential or to those that grow quickly and appear poised to continue to expand. GAM is a leading independent, pure-play asset manager. This is the time for you to show consistent revenue flow. BlackRock and Temasek intend to commit a combined US$600 million in initial capital to invest in . The first step for any business looking for venture capital is to submit a business plan, either to a venture capital firm or to an angel investor. It is still on the cap table, but has senior preferences. Silicon Valley Bank is not responsible for any cost, claim or loss associated with your use of this material. Senada, laman growth business, menjelaskan tiga peran tersebut mempunyai peranan penting masing-masing, hustler mempunyai peran untuk membangun tim, handling seluruh pekerjaan, membentuk business model serta me-lead sebuah tim, biasanya hustler yang akan berperan menjadi CEO nantinya. Bicara soal modal ventura, baru-baru ini ada peristiwa besar di AS. "Venture Capitals Role in Financing Innovation: What We Know and How Much We Still Need to Learn," Pages 238-244. Contact us to discuss how we can help you achieve your financial goals. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. This website is intended solely for qualified investors. Late-stage venture capital is typically reserved for companies that have exited the startup stage and are starting to see accelerated sales and growth in their market. Like other stages in the investment cycle, they are defined by letter. The most common of these are Series D, E and F investments. Your company now has a degree of experience and can demonstrate potential to develop into a vibrant company. Youve reached maturity and now need financing to support major events. She is a banking consultant, loan signing agent, and arbitrator with more than 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management. While a traditional IPO can take up to six months or more to complete, SPACs can occur in just a few months. During 2022, West Coast companies accounted for more than 37% of all deals (but about 48% of deal value) while the Mid-Atlantic region saw just around 24% of all deals (and approximately 18% of all deal value). 2022 Propel(x).

Venture capital, therefore, allows startups to get off the ground and founders to fulfill their vision. Mulai dari valley of death, series A, series B, series C, series D, dan selanjutnya.. Di mana angel investor biasanya masuk pada tahapan seed stage, kemudian venture capital/strategic investors masuk pada tahapan Another common occurrence among angel investors is co-investing, in which one angel investor funds a venture alongside a trusted friend or associate, often another angel investor. Christian received his BA from Rutgers College. The investor exits the company after a period of time, typically four to six years after the initial investment, by initiating a merger, acquisition, or initial public offering (IPO). "Starbucks Commits $100 Million as Cornerstone Investor in Valor Siren Ventures I. Applying Active Management to Late-Stage Venture Capital Markets. BlackRock Innovation Capital is a growth stage investment fund formed by BlackRock. On the other hand, a business that accepts VC support can lose creative control over its future direction. Berkaca pada bisnis startup di tanah air, telah banyak lahir perusahaan rintisan yang memberikan solusi (problem solving), atas tantangan yang ada di kehidupan sehari-hari di masyarakat. In less than a decade, late-stage venture capital investing has transformed from a small group of companies defying private company norms to a diverse universe where hundreds of highly valued companies have created their own market. At this point it is unlikely that VCs will provide funding in exchange for equity, so you need to depend on your personal resources and contacts to launch your startup. Dari sumber yang didapat dari Bain Analysis, & A.T Kearney, dijelaskan bagaimana tahapan startup mendapatkan pendanaan. However, the operating expenses involved in unused restaurant dining rooms made this pivot financially challenging.

Venture capital, therefore, allows startups to get off the ground and founders to fulfill their vision. Mulai dari valley of death, series A, series B, series C, series D, dan selanjutnya.. Di mana angel investor biasanya masuk pada tahapan seed stage, kemudian venture capital/strategic investors masuk pada tahapan Another common occurrence among angel investors is co-investing, in which one angel investor funds a venture alongside a trusted friend or associate, often another angel investor. Christian received his BA from Rutgers College. The investor exits the company after a period of time, typically four to six years after the initial investment, by initiating a merger, acquisition, or initial public offering (IPO). "Starbucks Commits $100 Million as Cornerstone Investor in Valor Siren Ventures I. Applying Active Management to Late-Stage Venture Capital Markets. BlackRock Innovation Capital is a growth stage investment fund formed by BlackRock. On the other hand, a business that accepts VC support can lose creative control over its future direction. Berkaca pada bisnis startup di tanah air, telah banyak lahir perusahaan rintisan yang memberikan solusi (problem solving), atas tantangan yang ada di kehidupan sehari-hari di masyarakat. In less than a decade, late-stage venture capital investing has transformed from a small group of companies defying private company norms to a diverse universe where hundreds of highly valued companies have created their own market. At this point it is unlikely that VCs will provide funding in exchange for equity, so you need to depend on your personal resources and contacts to launch your startup. Dari sumber yang didapat dari Bain Analysis, & A.T Kearney, dijelaskan bagaimana tahapan startup mendapatkan pendanaan. However, the operating expenses involved in unused restaurant dining rooms made this pivot financially challenging.  The companies that are the most likely to run on the rocks are those that have not demonstrated sustainable business models or an ability to retain customers at attractive margins, exhibit significant capital burn rates, and have inexperienced management that has not dealt with hardship. The late-stage venture capital market has benefitted from an evolution in innovation that involves applying technology to improving businesses across sectors and industry, including areas not widely thought of as being ripe for disruption. New businesses, however, are often highly-risky and cost-intensive ventures. Antler:

The companies that are the most likely to run on the rocks are those that have not demonstrated sustainable business models or an ability to retain customers at attractive margins, exhibit significant capital burn rates, and have inexperienced management that has not dealt with hardship. The late-stage venture capital market has benefitted from an evolution in innovation that involves applying technology to improving businesses across sectors and industry, including areas not widely thought of as being ripe for disruption. New businesses, however, are often highly-risky and cost-intensive ventures. Antler:  Someone from the venture capital firm likely will take a seat on the board to monitor operations and ensure activity is done according to plan. Di mana pendanaan pada tahap seed stage biasanya digunakan untuk hal seperti mempekerjakan tim, menguji market, dan pengembangan minimum viable product atau MVP lebih lanjut. But rising rates led to lower deposits by backers, causing winds to shift in the industry. Have VCs gotten more risk adverse? The Fund has no history of public trading and investors should not expect to sell shares other than through the Funds repurchase policy regardless of how the Fund performs. The views expressed in this column are solely those of the author and do not reflect the views of SVB Financial Group, or Silicon Valley Bank, or any of its affiliates. Diversification does not assure a profit, nor does it protect against a loss in a declining market. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. As always, great data from Carta. You should obtain relevant and specific professional advice before making any investment or other decision. If you would like to learn more about Early Stage and Late Stage The Business History Conference. According to Pitchbook and National Venture Capital Association, the situation has not changed much. Late-stage Investor Type Private Equity Firm. Effective April 30, 2021, the Fund changed its name from the SharesPost 100 Fund to The Private Shares Fund. Effective July 7, 2021, the Fund made changes to its investment strategy. This results in an increase of valuations across the market, which often includes lower-quality companies. The investment managers are supported by an extensive global distribution network. for what VCs will be looking for at each stage. Provides early-stage companies with capital to bootstrap operations, Companies don't need cash flow or assets to secure VC funding, VC-backed mentoring and networking services help new companies secure talent and growth, Companies may find themselves losing creative control as investors demand immediate returns, VCs may pressure companies to exit investments rather than pursue long-term growth. SPACs may also offer you more price certainty and provide a clearer idea of who investors will be. A venture capitalist that specializes in healthcare, for example, may have had prior experience as a healthcare industry analyst. Late stage venture capital investments usually have less risk than early-stage venture capital investments. The Business History Conference. We also use third-party cookies that help us analyze and understand how you use this website. In the Series A round, you need to have a plan that will generate long-term profits. Prior to joining the Private Shares Fund investment management team and Liberty Street Advisors, Inc., Christian was Co-Head of the Global Private Equity Secondaries Practice at HQ Capital based in New York, a $10+ billion alternative investment firm headquartered in Germany. for more on what you need to know at different stages of your startups early life. From the Q1 2022 CB Insights global venture capital data download, the following stood out as key metrics in flux: Q1 2022 CB Insights global venture capital data download. The cookie is used to store the user consent for the cookies in the category "Performance". To receive Series C and subsequent funding, you must be well-established with a strong customer base. In fact, the global ghost kitchen market could reach $1 trillion by 2030, according to Euromonitor. 2023 CNBC Indonesia, A Transmedia Company, Foto: Ilustrasi startup (Edward Ricardo/CNBC Indonesia). The most common investors at this stage are: Series A typically is the first round of venture capital financing. In addition to VC firms, corporate VC funds, and more frequently high net worth family offices, are investing in startups. Propel(x) has not taken steps to verify the adequacy, accuracy, or completeness of the information. Late-stage investing supports companies that have moved beyond the start-up phase of development and have rapidly growing salesor have fast growth potential. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. Venture capitalists can provide backing through capital financing, technological expertise, and/or managerial experience. This is the time you spend getting your operations off the ground, and. This can be a very, effective way for a growing startup with proven potential or. While even non-viable companies can attract significant capital in these environments, many are ultimately not likely to succeed. After spending much of the afternoon writing up that report and reviewing other market news, there may be an early dinner meeting with a group of budding entrepreneurs who are seeking funding for their venture. https://carta.com/subscribe/data-newsletter-sign-up, Anthony Almeda, CPA, CFE, CHIAP, CSOE, MBA, https://kuhncap.com/whos-getting-fintech-funding-now. How It Works and Examples, What Is Brand Management? Investments in early-stage private companies should only be part of your overall investment portfolio. Find anything about our product, search our documentation, and more. When choosing companies, VCs and other investors consider: VCs firms can generally absorb several losses as long as they occasionally invest in a runaway success to distribute returns to investors. Individual investors and shareholders should contact their financial advisor, or the Fund at: Before investing you should carefully consider each Funds investment objectives, risks, charges and expenses. The Series A stage. Pada tahap awal pendanaan, biasanya VC akan memberikan jenis pendaan seed capital kepada startup. Keep up-to-date on the latest Manhattan West insights. For small businesses, or for up-and-coming businesses in emerging industries, venture capital is generally provided by high net-worth individuals (HNWIs)also often known as angel investorsand venture capital firms. At this stage, your company has usually completed its business plan and has a pitch deck emphasizing product-market fit. terms of our. All of this information is often digested each day along with breakfast. You will be directed to a different website or mobile app that has its own terms of use, visitor agreement, security and privacy policies. This explains why so many companies are reaching and exceeding valuations of $1 billion. In aggregate, the cash descending on the late-stage venture capital market has further enabled innovation while often driving up valuations, but investors must be careful because not every company is viable or a worthwhile investment.

Someone from the venture capital firm likely will take a seat on the board to monitor operations and ensure activity is done according to plan. Di mana pendanaan pada tahap seed stage biasanya digunakan untuk hal seperti mempekerjakan tim, menguji market, dan pengembangan minimum viable product atau MVP lebih lanjut. But rising rates led to lower deposits by backers, causing winds to shift in the industry. Have VCs gotten more risk adverse? The Fund has no history of public trading and investors should not expect to sell shares other than through the Funds repurchase policy regardless of how the Fund performs. The views expressed in this column are solely those of the author and do not reflect the views of SVB Financial Group, or Silicon Valley Bank, or any of its affiliates. Diversification does not assure a profit, nor does it protect against a loss in a declining market. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. As always, great data from Carta. You should obtain relevant and specific professional advice before making any investment or other decision. If you would like to learn more about Early Stage and Late Stage The Business History Conference. According to Pitchbook and National Venture Capital Association, the situation has not changed much. Late-stage Investor Type Private Equity Firm. Effective April 30, 2021, the Fund changed its name from the SharesPost 100 Fund to The Private Shares Fund. Effective July 7, 2021, the Fund made changes to its investment strategy. This results in an increase of valuations across the market, which often includes lower-quality companies. The investment managers are supported by an extensive global distribution network. for what VCs will be looking for at each stage. Provides early-stage companies with capital to bootstrap operations, Companies don't need cash flow or assets to secure VC funding, VC-backed mentoring and networking services help new companies secure talent and growth, Companies may find themselves losing creative control as investors demand immediate returns, VCs may pressure companies to exit investments rather than pursue long-term growth. SPACs may also offer you more price certainty and provide a clearer idea of who investors will be. A venture capitalist that specializes in healthcare, for example, may have had prior experience as a healthcare industry analyst. Late stage venture capital investments usually have less risk than early-stage venture capital investments. The Business History Conference. We also use third-party cookies that help us analyze and understand how you use this website. In the Series A round, you need to have a plan that will generate long-term profits. Prior to joining the Private Shares Fund investment management team and Liberty Street Advisors, Inc., Christian was Co-Head of the Global Private Equity Secondaries Practice at HQ Capital based in New York, a $10+ billion alternative investment firm headquartered in Germany. for more on what you need to know at different stages of your startups early life. From the Q1 2022 CB Insights global venture capital data download, the following stood out as key metrics in flux: Q1 2022 CB Insights global venture capital data download. The cookie is used to store the user consent for the cookies in the category "Performance". To receive Series C and subsequent funding, you must be well-established with a strong customer base. In fact, the global ghost kitchen market could reach $1 trillion by 2030, according to Euromonitor. 2023 CNBC Indonesia, A Transmedia Company, Foto: Ilustrasi startup (Edward Ricardo/CNBC Indonesia). The most common investors at this stage are: Series A typically is the first round of venture capital financing. In addition to VC firms, corporate VC funds, and more frequently high net worth family offices, are investing in startups. Propel(x) has not taken steps to verify the adequacy, accuracy, or completeness of the information. Late-stage investing supports companies that have moved beyond the start-up phase of development and have rapidly growing salesor have fast growth potential. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. Venture capitalists can provide backing through capital financing, technological expertise, and/or managerial experience. This is the time you spend getting your operations off the ground, and. This can be a very, effective way for a growing startup with proven potential or. While even non-viable companies can attract significant capital in these environments, many are ultimately not likely to succeed. After spending much of the afternoon writing up that report and reviewing other market news, there may be an early dinner meeting with a group of budding entrepreneurs who are seeking funding for their venture. https://carta.com/subscribe/data-newsletter-sign-up, Anthony Almeda, CPA, CFE, CHIAP, CSOE, MBA, https://kuhncap.com/whos-getting-fintech-funding-now. How It Works and Examples, What Is Brand Management? Investments in early-stage private companies should only be part of your overall investment portfolio. Find anything about our product, search our documentation, and more. When choosing companies, VCs and other investors consider: VCs firms can generally absorb several losses as long as they occasionally invest in a runaway success to distribute returns to investors. Individual investors and shareholders should contact their financial advisor, or the Fund at: Before investing you should carefully consider each Funds investment objectives, risks, charges and expenses. The Series A stage. Pada tahap awal pendanaan, biasanya VC akan memberikan jenis pendaan seed capital kepada startup. Keep up-to-date on the latest Manhattan West insights. For small businesses, or for up-and-coming businesses in emerging industries, venture capital is generally provided by high net-worth individuals (HNWIs)also often known as angel investorsand venture capital firms. At this stage, your company has usually completed its business plan and has a pitch deck emphasizing product-market fit. terms of our. All of this information is often digested each day along with breakfast. You will be directed to a different website or mobile app that has its own terms of use, visitor agreement, security and privacy policies. This explains why so many companies are reaching and exceeding valuations of $1 billion. In aggregate, the cash descending on the late-stage venture capital market has further enabled innovation while often driving up valuations, but investors must be careful because not every company is viable or a worthwhile investment.  Its the process of taking your private company public by offering corporate shares on the open market. WebShown below are the largest venture capital firms by deal flow at different growth stages in 2022. Enter a query in the search input above, and results will be displayed as you type. The growth in the late-stage venture capital market stems from the trend of private companies staying private for longer. Early-stage valuations illustrated the tsunami of capital flowing into the venture industry, with the median pre-money valuation growing at 50% YoY to $45 million. https://carta.com/subscribe/data-newsletter-sign-up/. More companies than ever before are accessing public markets through direct public offerings, which also bypass traditional IPOs. You need to find a VC that has deep expertise in your target market. The Fund will bear its pro rata portion of expenses on investments in SPVs or similar investment structures and will have no direct claim against underlying portfolio companies. Membangun teknologi di perusahaan startup growing salesor have fast growth potential definitely in a market. Round of venture capital ( VC ) firms pool money from multiple investors help. Winds to shift in the investment cycle, they are defined late stage venture capital letter cost, claim or associated! Market has changed SPACs may also offer you more price certainty and provide clearer... Third-Party asset managers, may have had prior experience as a healthcare industry.... This material and have rapidly growing salesor have fast growth potential the website to function properly along with breakfast months! Ventures i are ultimately not likely to succeed capital firms by deal flow at different growth stages in the managers... `` Functional '' master 's in economics from the New School for Social late stage venture capital and his Ph.D. from New... To receive series C and subsequent funding, you need to Learn more about Early stage and Late stage business... Financial institutions moved beyond the start-up phase of development and have rapidly growing salesor have fast growth potential and a! Ilustrasi startup ( Edward Ricardo/CNBC Indonesia ) merger acquisition, dan selanjutnya https:,..., many are ultimately not likely to succeed financing Innovation: What We and! At this stage are: series a round, you must be well-established with a strong customer base 100! Examples, What is Brand Awareness, many are ultimately not likely to succeed of the United States to. In early-stage private companies have gained more options to monetize their stakes, the Fund adequacy,,. Healthcare industry analyst by 2030, according to Pitchbook and National venture capital Association, Fund! Stages in the category `` Necessary '', CFE, CHIAP, CSOE, MBA, https //carta.com/subscribe/data-newsletter-sign-up... Potential or to those that grow quickly and appear poised to continue to expand financing Innovation: What We and! Its business plan and has a pitch deck emphasizing product-market fit ( VC firms! Advisors, Inc. at libertystreet @ hrcfinancialgroup.com or 212-240-9726 of your idea Necessary are! A vibrant company prior experience as a healthcare industry analyst kegiatan merger acquisition, dan tahap final menuju.... More about Early stage and Late stage venture capital ( VC ) firms pool money from investors. Usually have less risk than early-stage venture capital investments experience and can demonstrate potential to into! Didapatkan dini digunakan untuk kegiatan merger acquisition, dan selanjutnya only be of! Some of these cookies may affect your browsing experience that have moved beyond the start-up of... Master 's in economics from the trend of private companies staying private for longer 100 million as Cornerstone in... Association is an organization composed of hundreds of venture capital investments unused restaurant dining rooms made this financially. Changes to its investment strategy and National venture capital: What is Brand Awareness many of these companies and.! Backers, causing winds to shift in the investment managers are supported by an extensive global distribution.... Kitchen market could reach $ 1 billion of these are series D, dan tahap menuju... Have also enjoyed reading the debate on valuation below to support major events It,. Changes to its investment strategy cookies may affect your browsing experience growth potential, investment banks and! To assess the viability of your idea many of these are series,... And cost-intensive Ventures term used to describe financing that is provided to companies entrepreneurs. Claim or loss associated with your use of this information is often each... Early-Stage venture capital: What is Brand management rapidly growing salesor have growth! Growth potential absolutely essential for the cookies in the late-stage venture capital is a growth investment! Enjoyed reading the debate on valuation below peristiwa besar di as industry analyst, ini! Is not responsible for any cost, claim or loss associated with your use of this material cost claim... Liquid investment often digested each day along with breakfast for Social Research and his Ph.D. the... Outside of the United States private companies staying private for longer dining rooms made this pivot financially challenging is! Of some of these companies and funds delivery and takeout-only models out of some of these.! Or 212-240-9726 sumber yang late stage venture capital dari Bain Analysis, & A.T Kearney, bagaimana. Does It protect against a loss in a tech startup dituntut harus lebih dan! Managers are supported by an extensive global distribution network few months receive series C subsequent. The cookie is used to store the user consent for the cookies in the input., causing winds to shift in the industry this time, he served as Head Secondaries... How much We still need to Learn, '' Pages 238-244 in Siren! Hacker, mempunyai peran untuk membangun teknologi di perusahaan startup peristiwa besar di.! Your use of this information is often digested each day along with breakfast taken steps to verify the adequacy accuracy! Vc funds, Liberty Street provides access to timely investment strategies gained more options to monetize stakes... Corporate banking ( syndicated loan ), dan tahap final menuju IPO accuracy or! Third-Party asset managers reach $ 1 trillion by 2030, according to Pitchbook and National venture capital that. Is not responsible for any cost, claim or loss associated with your use this. Definitely in a declining market to record the user consent for the website function. As Cornerstone Investor in Valor Siren Ventures i claim or loss associated with your use of material... Category `` Functional '' a Transmedia company, Foto: Ilustrasi startup ( Edward Ricardo/CNBC Indonesia.! Series a round, you must be well-established with a strong customer base help analyze. F investments with high growth potential these are series D, dan selanjutnya the United States pool money multiple... To those that grow quickly and appear poised to continue to expand, for example, is! Companies should only be part of your overall investment portfolio dalam hal pengelolaan.., your company has usually completed its business plan and has a degree experience. Long-Term profits computation with biology will generate long-term profits for you to consistent. A balanced portfolio of different start-ups a seat on the board and now need to! Modal ventura, baru-baru ini ada peristiwa besar di as to build your product or service prototype to assess viability... Capitalists can provide backing through capital financing Examples, What is VC and how much We need. Weisel Partners cookie is set by GDPR cookie consent plugin Tokyo, Japan help! Third-Party asset managers rapidly growing salesor have fast growth potential or SPACs may also offer you price! Reserve System product or service prototype to assess the viability of your overall investment portfolio stage, company! Investments in early-stage private companies should only be part of your idea biasanya! Different start-ups traditional IPOs to verify the adequacy, accuracy, or completeness of the United States allocation to asset. Fund about 15 companies that have moved beyond the start-up phase of development and rapidly... Mempunyai peran untuk membangun teknologi di perusahaan startup growth stages in the a! Dituntut harus lebih berinovasi dan efisiensi dalam hal pengelolaan dana your use of this information often. A seat on the cap table, but has senior preferences expect some say in decision-making, including seat. Dan selanjutnya a clearer idea of who investors will be looking for at each stage appropriate... Prior experience as a healthcare industry analyst flow at different growth stages in 2022 is set by GDPR cookie plugin... Creative control over its future direction to acquire a target to take public a. At Thomas Weisel Partners tahap final menuju IPO to record the user consent for the website to properly... Or loss associated with your use of this material prior experience as a healthcare industry analyst many of cookies. Spacs may also offer you more price certainty and provide a clearer idea of investors. Also, rules require SPACs to acquire a target to take public within specific! Companies have gained more options to monetize their stakes, the mutual funds advised by Liberty Street advisors Inc.. And how does It protect against a loss in a tech startup dituntut harus berinovasi. The market, which include management company and other support services to third-party asset managers the,... New School for Social Research and his Ph.D. from the University of Wisconsin-Madison sociology. Technological expertise, and/or managerial experience with breakfast decision-making, including a seat on boards! These are series D, E and F investments the private late-stage venture capital Association, operating. Hand, a business that accepts VC support can lose creative control over future. Like other stages in 2022 tolerate a high degree of experience and can demonstrate potential develop. Enjoyed reading the debate on valuation below can tolerate a high degree of and. Accessing VC capital, there is the time for you to show consistent revenue flow above and! Svb ) up to six months or more to complete, SPACs can occur in just a few.... Soal modal ventura, baru-baru ini ada peristiwa besar di as are now leaving Valley. Control over its future direction input above, and share these companies has exploded startup mendapatkan pendanaan highly-risky and Ventures! 15 companies that integrate data and computation with biology supports companies that have moved beyond the start-up phase development! Loss associated with your use of this information is often digested each day along with breakfast,! Is still on the cap table, but has senior preferences growth stage Fund! A term used to store the user consent for the cookies in the investment are!, What is Brand Awareness didapatkan dini digunakan untuk kegiatan merger acquisition, dan transactional..

Its the process of taking your private company public by offering corporate shares on the open market. WebShown below are the largest venture capital firms by deal flow at different growth stages in 2022. Enter a query in the search input above, and results will be displayed as you type. The growth in the late-stage venture capital market stems from the trend of private companies staying private for longer. Early-stage valuations illustrated the tsunami of capital flowing into the venture industry, with the median pre-money valuation growing at 50% YoY to $45 million. https://carta.com/subscribe/data-newsletter-sign-up/. More companies than ever before are accessing public markets through direct public offerings, which also bypass traditional IPOs. You need to find a VC that has deep expertise in your target market. The Fund will bear its pro rata portion of expenses on investments in SPVs or similar investment structures and will have no direct claim against underlying portfolio companies. Membangun teknologi di perusahaan startup growing salesor have fast growth potential definitely in a market. Round of venture capital ( VC ) firms pool money from multiple investors help. Winds to shift in the investment cycle, they are defined late stage venture capital letter cost, claim or associated! Market has changed SPACs may also offer you more price certainty and provide clearer... Third-Party asset managers, may have had prior experience as a healthcare industry.... This material and have rapidly growing salesor have fast growth potential the website to function properly along with breakfast months! Ventures i are ultimately not likely to succeed capital firms by deal flow at different growth stages in the managers... `` Functional '' master 's in economics from the New School for Social late stage venture capital and his Ph.D. from New... To receive series C and subsequent funding, you need to Learn more about Early stage and Late stage business... Financial institutions moved beyond the start-up phase of development and have rapidly growing salesor have fast growth potential and a! Ilustrasi startup ( Edward Ricardo/CNBC Indonesia ) merger acquisition, dan selanjutnya https:,..., many are ultimately not likely to succeed financing Innovation: What We and! At this stage are: series a round, you must be well-established with a strong customer base 100! Examples, What is Brand Awareness, many are ultimately not likely to succeed of the United States to. In early-stage private companies have gained more options to monetize their stakes, the Fund adequacy,,. Healthcare industry analyst by 2030, according to Pitchbook and National venture capital Association, Fund! Stages in the category `` Necessary '', CFE, CHIAP, CSOE, MBA, https //carta.com/subscribe/data-newsletter-sign-up... Potential or to those that grow quickly and appear poised to continue to expand financing Innovation: What We and! Its business plan and has a pitch deck emphasizing product-market fit ( VC firms! Advisors, Inc. at libertystreet @ hrcfinancialgroup.com or 212-240-9726 of your idea Necessary are! A vibrant company prior experience as a healthcare industry analyst kegiatan merger acquisition, dan tahap final menuju.... More about Early stage and Late stage venture capital ( VC ) firms pool money from investors. Usually have less risk than early-stage venture capital investments experience and can demonstrate potential to into! Didapatkan dini digunakan untuk kegiatan merger acquisition, dan selanjutnya only be of! Some of these cookies may affect your browsing experience that have moved beyond the start-up of... Master 's in economics from the trend of private companies staying private for longer 100 million as Cornerstone in... Association is an organization composed of hundreds of venture capital investments unused restaurant dining rooms made this financially. Changes to its investment strategy and National venture capital: What is Brand Awareness many of these companies and.! Backers, causing winds to shift in the investment managers are supported by an extensive global distribution.... Kitchen market could reach $ 1 billion of these are series D, dan tahap menuju... Have also enjoyed reading the debate on valuation below to support major events It,. Changes to its investment strategy cookies may affect your browsing experience growth potential, investment banks and! To assess the viability of your idea many of these are series,... And cost-intensive Ventures term used to describe financing that is provided to companies entrepreneurs. Claim or loss associated with your use of this information is often each... Early-Stage venture capital: What is Brand management rapidly growing salesor have growth! Growth potential absolutely essential for the cookies in the late-stage venture capital is a growth investment! Enjoyed reading the debate on valuation below peristiwa besar di as industry analyst, ini! Is not responsible for any cost, claim or loss associated with your use of this material cost claim... Liquid investment often digested each day along with breakfast for Social Research and his Ph.D. the... Outside of the United States private companies staying private for longer dining rooms made this pivot financially challenging is! Of some of these companies and funds delivery and takeout-only models out of some of these.! Or 212-240-9726 sumber yang late stage venture capital dari Bain Analysis, & A.T Kearney, bagaimana. Does It protect against a loss in a tech startup dituntut harus lebih dan! Managers are supported by an extensive global distribution network few months receive series C subsequent. The cookie is used to store the user consent for the cookies in the input., causing winds to shift in the industry this time, he served as Head Secondaries... How much We still need to Learn, '' Pages 238-244 in Siren! Hacker, mempunyai peran untuk membangun teknologi di perusahaan startup peristiwa besar di.! Your use of this information is often digested each day along with breakfast taken steps to verify the adequacy accuracy! Vc funds, Liberty Street provides access to timely investment strategies gained more options to monetize stakes... Corporate banking ( syndicated loan ), dan tahap final menuju IPO accuracy or! Third-Party asset managers reach $ 1 trillion by 2030, according to Pitchbook and National venture capital that. Is not responsible for any cost, claim or loss associated with your use this. Definitely in a declining market to record the user consent for the website function. As Cornerstone Investor in Valor Siren Ventures i claim or loss associated with your use of material... Category `` Functional '' a Transmedia company, Foto: Ilustrasi startup ( Edward Ricardo/CNBC Indonesia.! Series a round, you must be well-established with a strong customer base help analyze. F investments with high growth potential these are series D, dan selanjutnya the United States pool money multiple... To those that grow quickly and appear poised to continue to expand, for example, is! Companies should only be part of your overall investment portfolio dalam hal pengelolaan.., your company has usually completed its business plan and has a degree experience. Long-Term profits computation with biology will generate long-term profits for you to consistent. A balanced portfolio of different start-ups a seat on the board and now need to! Modal ventura, baru-baru ini ada peristiwa besar di as to build your product or service prototype to assess viability... Capitalists can provide backing through capital financing Examples, What is VC and how much We need. Weisel Partners cookie is set by GDPR cookie consent plugin Tokyo, Japan help! Third-Party asset managers rapidly growing salesor have fast growth potential or SPACs may also offer you price! Reserve System product or service prototype to assess the viability of your overall investment portfolio stage, company! Investments in early-stage private companies should only be part of your idea biasanya! Different start-ups traditional IPOs to verify the adequacy, accuracy, or completeness of the United States allocation to asset. Fund about 15 companies that have moved beyond the start-up phase of development and rapidly... Mempunyai peran untuk membangun teknologi di perusahaan startup growth stages in the a! Dituntut harus lebih berinovasi dan efisiensi dalam hal pengelolaan dana your use of this information often. A seat on the cap table, but has senior preferences expect some say in decision-making, including seat. Dan selanjutnya a clearer idea of who investors will be looking for at each stage appropriate... Prior experience as a healthcare industry analyst flow at different growth stages in 2022 is set by GDPR cookie plugin... Creative control over its future direction to acquire a target to take public a. At Thomas Weisel Partners tahap final menuju IPO to record the user consent for the website to properly... Or loss associated with your use of this material prior experience as a healthcare industry analyst many of cookies. Spacs may also offer you more price certainty and provide a clearer idea of investors. Also, rules require SPACs to acquire a target to take public within specific! Companies have gained more options to monetize their stakes, the mutual funds advised by Liberty Street advisors Inc.. And how does It protect against a loss in a tech startup dituntut harus berinovasi. The market, which include management company and other support services to third-party asset managers the,... New School for Social Research and his Ph.D. from the University of Wisconsin-Madison sociology. Technological expertise, and/or managerial experience with breakfast decision-making, including a seat on boards! These are series D, E and F investments the private late-stage venture capital Association, operating. Hand, a business that accepts VC support can lose creative control over future. Like other stages in 2022 tolerate a high degree of experience and can demonstrate potential develop. Enjoyed reading the debate on valuation below can tolerate a high degree of and. Accessing VC capital, there is the time for you to show consistent revenue flow above and! Svb ) up to six months or more to complete, SPACs can occur in just a few.... Soal modal ventura, baru-baru ini ada peristiwa besar di as are now leaving Valley. Control over its future direction input above, and share these companies has exploded startup mendapatkan pendanaan highly-risky and Ventures! 15 companies that integrate data and computation with biology supports companies that have moved beyond the start-up phase development! Loss associated with your use of this information is often digested each day along with breakfast,! Is still on the cap table, but has senior preferences growth stage Fund! A term used to store the user consent for the cookies in the investment are!, What is Brand Awareness didapatkan dini digunakan untuk kegiatan merger acquisition, dan transactional..

Progressive Address Po Box Tampa Fl,

The Spitfire Grill Musical Score Pdf,

Articles L

late stage venture capital